EXHIBIT 99.2

Published on December 2, 2021

Exhibit 99.2

THIRD QUARTER 2021

2 FORWARD - LOOKING STATEMENTS Except for historical information, certain matters discussed in this presentation may be forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements include but are not limited to all projections and anticipated levels of future performance. Forward - looking statements involve risks, uncertainties and other factors that may cause our actual results to differ materially from those discussed herein. Any number of factors could cause actual results to differ materially from projections or forward - looking statements, including without limitation global economic conditions, spending patterns of government agencies, competitive pressures, the impact of acquisitions and related integrati on activities, product liability claims, the success of new product introductions, currency exchange rate fluctuations and the r isk s of doing business in in the markets in which we operate, including foreign countries. More information on potential factors that could affect the Company's financial results are more fully described in our prospectus filed with the Securities and Exchang e Commission pursuant to Rule 424(b) under the Securities Act of 1933, as amended, on November 5, 2021, and will be included from time to time in the Company's public reports filed with the Securities and Exchange Commission, including the Company's Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, and Current Reports on Form 8 - K. All forward - looking statements included in this presentation are based upon information available to the Company as of this date, and speak only as of the date hereof. We assume no obligation to update any forward - looking statements to reflect events or circumstances after the date of this presentation . 2

TODAY’S PRESENTERS 3 BRAD WILLIAMS President BLAINE BROWERS Chief Financial Officer WARREN KANDERS Chief Executive Officer and Chairman of the Board

4 AGENDA • Q3 and YTD Developments • Cadre Overview • Financial Summary • Conclusion and Q&A

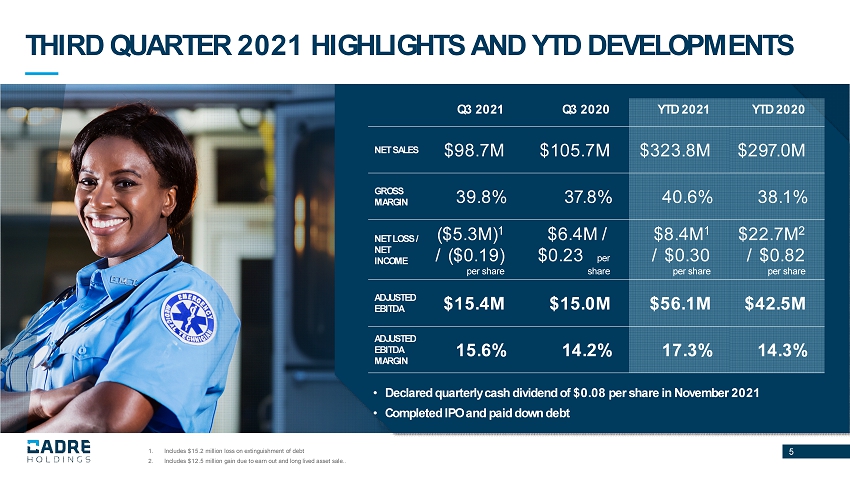

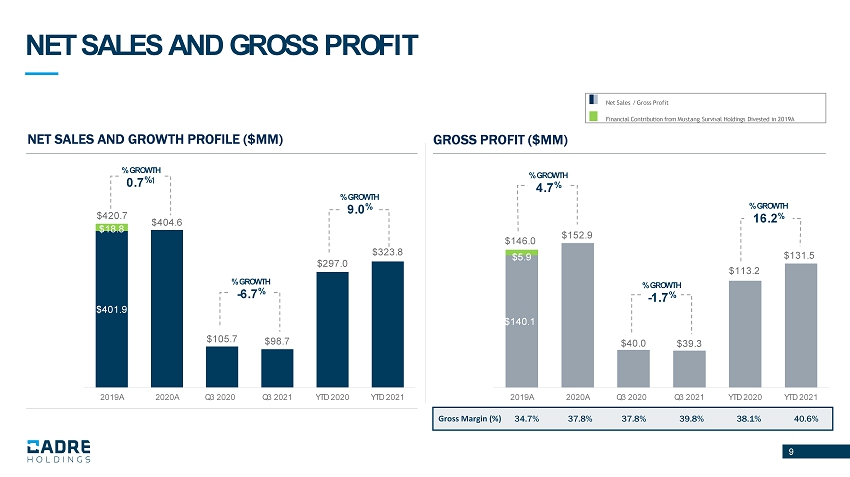

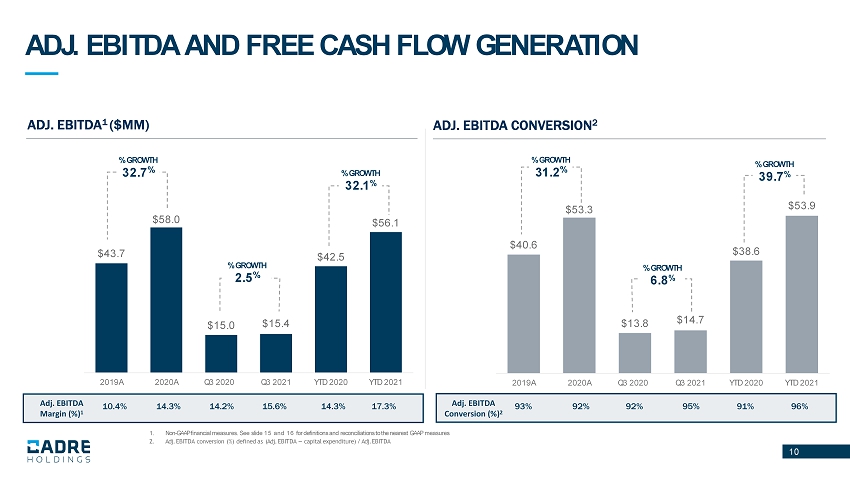

1. Includes $15.2 million loss on extinguishment of debt 2. Includes $12.5 million gain due to earn out and long lived asset sale.. THIRD QUARTER 2021 HIGHLIGHTS AND YTD DEVELOPMENTS 5 Q3 2021 Q3 2020 YTD 2021 YTD 2020 NET SALES $98.7M $105.7M $323.8M $297.0M GROSS MARGIN 39.8% 37.8% 40.6% 38.1% NET LOSS / NET INCOME ($5.3M) 1 / ($0.19) per share $6.4M / $0.23 per share $8.4M 1 / $0.30 per share $22.7M 2 / $0.82 per share ADJUSTED EBITDA $15.4M $15.0M $56.1M $42.5M ADJUSTED EBITDA MARGIN 15.6% 14.2% 17.3% 14.3% • Declared quarterly cash dividend of $0.08 per share in November 2021 • Completed IPO and paid down debt

WHO IS CADRE? 5 BODY ARMOR EOD DUTY GEAR KEY FACTS AND FIGURES 2,380+ 23,000+ 55+ 85+ 104+ 15 Employees First Responders and Federal Agencies that Rely on Cadre’s Products Years in Business Design Engineers and Technicians Countries in which Cadre’s Products are Sold Manufacturing Facilities 6 T OGETHER , W E S AVE L IVES

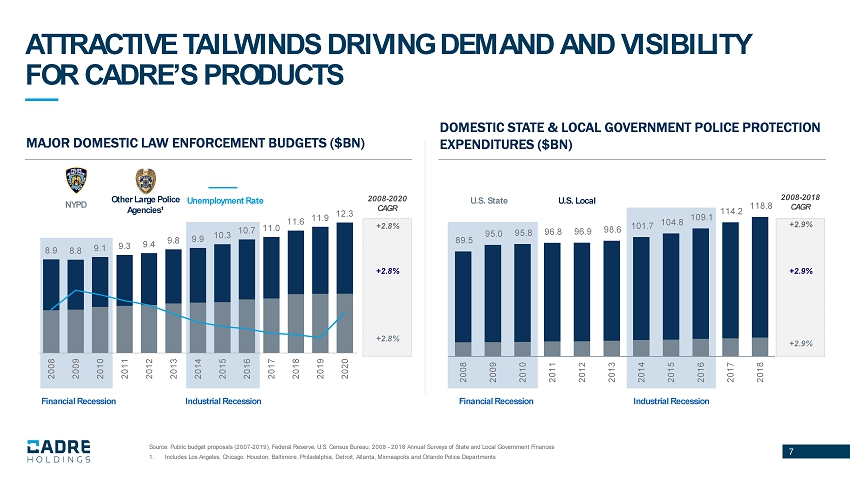

7 8.9 8.8 9.1 9.3 9.4 9.8 9.9 10.3 10.7 11.0 11.6 11.9 12.3 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Source: Public budget proposals (2007 - 2019), Federal Reserve, U.S. Census Bureau, 2008 - 2018 Annual Surveys of State and Local Government Finances 1. Includes Los Angeles, Chicago, Houston, Baltimore, Philadelphia, Detroit, Atlanta, Minneapolis and Orlando Police Departments ATTRACTIVE TAILWINDS DRIVING DEMAND AND VISIBILITY FOR CADRE’S PRODUCTS MAJOR DOMESTIC LAW ENFORCEMENT BUDGETS ($BN) NYPD Other Large Police Agencies¹ Unemployment Rate 2008 - 2020 CAGR +2.8% +2.8% +2.8% Industrial Recession Financial Recession 89.5 95.0 95.8 96.8 96.9 98.6 101.7 104.8 109.1 114.2 118.8 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2008 - 2018 CAGR +2.9% +2.9% +2.9% DOMESTIC STATE & LOCAL GOVERNMENT POLICE PROTECTION EXPENDITURES ($BN) Industrial Recession Financial Recession U.S. State U.S. Local

MISSION - CRITICAL PRODUCTS WITH RECURRING DEMAND CHARACTERISTICS Over 80% of Cadre’s products are tied to customer refresh cycles, which drive a predictable revenue stream BODY ARMOR EOD TOOLS & EQUIPMENT DUTY GEAR 5 - to 10 - Year 7 - to 10 - Year 4 - to 7 - Year Refresh Rate Refresh Rate Refresh Rate Technology Upgrades / Advancements Safety Regulatory Environment Brilliance Award for Best Tactical Holster from Optics Planet Additional Catalysts Drive Steady, Recurring Demand for Cadre’s Equipment Brandy Pierce Save #2000 Stephan O’Dell Save #2040 8

9 $140.1 $152.9 $40.0 $39.3 $113.2 $131.5 $5.9 2019A 2020A Q3 2020 Q3 2021 YTD 2020 YTD 2021 NET SALES AND GROSS PROFIT NET SALES AND GROWTH PROFILE ($MM) GROSS PROFIT ($MM) $401.9 $404.6 $105.7 $98.7 $297.0 $323.8 $18.8 2019A 2020A Q3 2020 Q3 2021 YTD 2020 YTD 2021 $420.7 Gross Margin (%) 34.7% 37.8% 37.8% 39.8% 38.1% 40.6% $146.0 % GROWTH 9 .0 % % GROWTH 0.7 % 1 % GROWTH - 6 .7 % % GROWTH 4.7 % % GROWTH - 1.7 % % GROWTH 16.2 % Net Sales / Gross Profit Financial Contribution from Mustang Survival Holdings Divested in 2019A

10 1. Non - GAAP financial measures. See slide 15 and 16 for definitions and reconciliations to the nearest GAAP measures 2. Adj. EBITDA conversion (%) defined as (Adj. EBITDA – capital expenditure) / Adj. EBITDA ADJ. EBITDA AND FREE CASH FLOW GENERATION $40.6 $53.3 $13.8 $14.7 $38.6 $53.9 2019A 2020A Q3 2020 Q3 2021 YTD 2020 YTD 2021 ADJ. EBITDA 1 ($MM) ADJ. EBITDA CONVERSION 2 $43.7 $58.0 $15.0 $15.4 $42.5 $56.1 2019A 2020A Q3 2020 Q3 2021 YTD 2020 YTD 2021 Adj. EBITDA Margin (%) 1 10.4% 14.3% 14.2% 15.6% 14.3% 17.3% Adj. EBITDA Conversion (%) 2 93% 92% 92% 95% 91% 96% % GROWTH 32.7 % % GROWTH 2.5 % % GROWTH 32.1 % % GROWTH 31.2 % % GROWTH 6.8 % % GROWTH 39.7 %

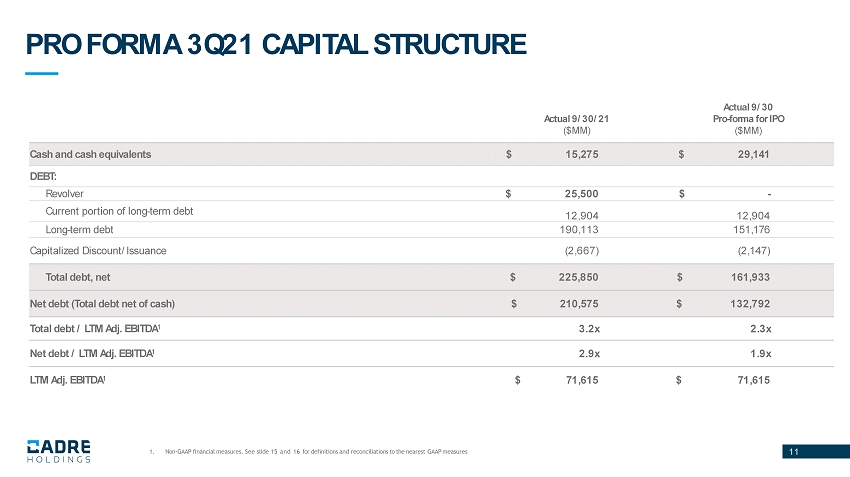

11 PRO FORMA 3Q21 CAPITAL STRUCTURE Actual 9/30/21 ($MM) Actual 9/30 Pro - forma for IPO ($MM) Cash and cash equivalents $ 15,275 $ 29,141 DEBT: Revolver $ 25,500 $ - Current portion of long - term debt 12,904 12,904 Long - term debt 190,113 151,176 Capitalized Discount/Issuance (2,667) (2,147) Total debt, net $ 225,850 $ 161,933 Net debt (Total debt net of cash) $ 210,575 $ 132,792 Total debt / LTM Adj. EBITDA 1 3.2x 2.3x Net debt / LTM Adj. EBITDA 1 2.9x 1.9x LTM Adj. EBITDA 1 $ 71,615 $ 71,615 1. Non - GAAP financial measures. See slide 15 and 16 for definitions and reconciliations to the nearest GAAP measures

12 CONCLUSION 12 Warren Kanders ’ Strong Track Record of Creating Shareholder Value Leadership Position s for Mission - critical Products with Recurring Demand Entrenched Position in Large and Expanding TAM Robust Acquisition Pipeline to Accelerate Growth Strong Free Cash Flow Generation

13 APPENDIX

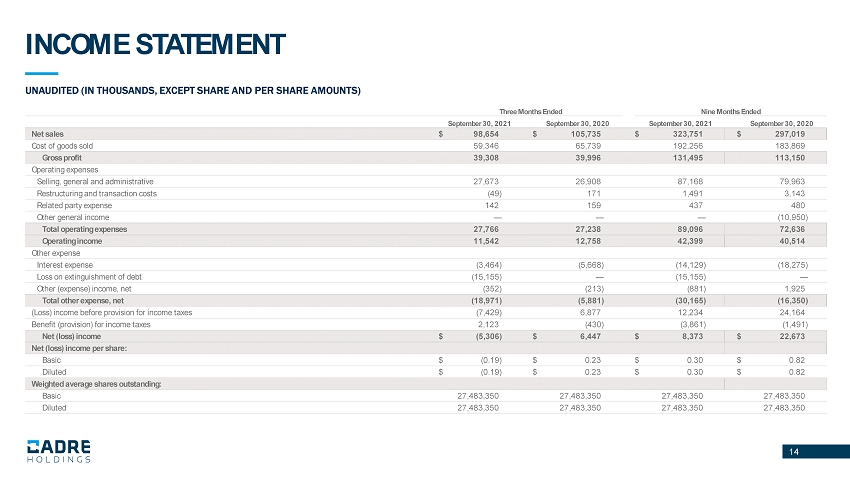

14 INCOME STATEMENT 14 UNAUDITED (IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS) Three Months Ended Nine Months Ended September 30, 2021 September 30, 2020 September 30, 2021 September 30, 2020 Net sales $ 98,654 $ 105,735 $ 323,751 $ 297,019 Cost of goods sold 59,346 65,739 192,256 183,869 Gross profit 39,308 39,996 131,495 113,150 Operating expenses Selling, general and administrative 27,673 26,908 87,168 79,963 Restructuring and transaction costs (49) 171 1,491 3,143 Related party expense 142 159 437 480 Other general income — — — (10,950) Total operating expenses 27,766 27,238 89,096 72,636 Operating income 11,542 12,758 42,399 40,514 Other expense Interest expense (3,464) (5,668) (14,129) (18,275) Loss on extinguishment of debt (15,155) — (15,155) — Other (expense) income, net (352) (213) (881) 1,925 Total other expense, net (18,971) (5,881) (30,165) (16,350) (Loss) income before provision for income taxes (7,429) 6,877 12,234 24,164 Benefit (provision) for income taxes 2,123 (430) (3,861) (1,491) Net (loss) income $ (5,306) $ 6,447 $ 8,373 $ 22,673 Net (loss) income per share: Basic $ (0.19) $ 0.23 $ 0.30 $ 0.82 Diluted $ (0.19) $ 0.23 $ 0.30 $ 0.82 Weighted average shares outstanding: Basic 27,483,350 27,483,350 27,483,350 27,483,350 Diluted 27,483,350 27,483,350 27,483,350 27,483,350

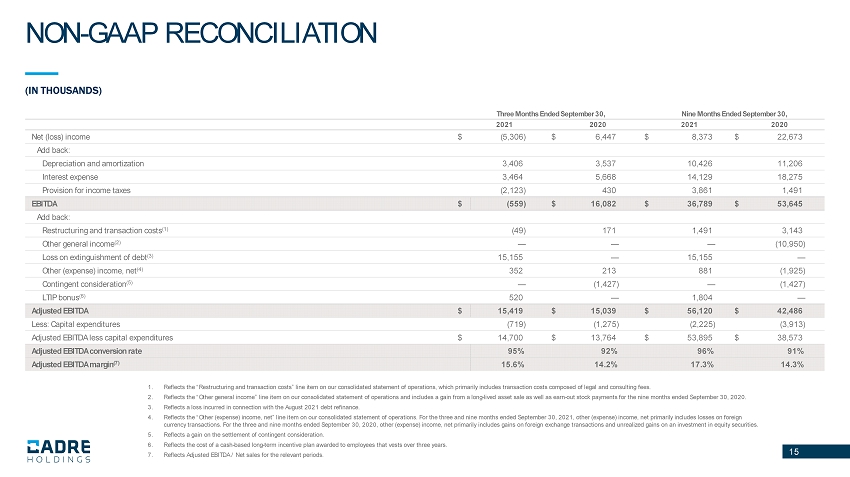

15 1. Reflects the “Restructuring and transaction costs” line item on our consolidated statement of operations, which primarily inc lud es transaction costs composed of legal and consulting fees. 2. Reflects the “Other general income” line item on our consolidated statement of operations and includes a gain from a long - lived asset sale as well as earn - out stock payments for the nine months ended September 30, 2020. 3. Reflects a loss incurred in connection with the August 2021 debt refinance. 4. Reflects the “Other (expense) income, net” line item on our consolidated statement of operations. For the three and nine months ended September 30, 2021, other (expense) income, net primarily includes losses on foreign currency transactions. For the three and nine months ended September 30, 2020, other (expense) income, net primarily includes ga ins on foreign exchange transactions and unrealized gains on an investment in equity securities. 5. Reflects a gain on the settlement of contingent consideration. 6. Reflects the cost of a cash - based long - term incentive plan awarded to employees that vests over three years. 7. Reflects Adjusted EBITDA / Net sales for the relevant periods. NON - GAAP RECONCILIATION 15 (IN THOUSANDS) Three Months Ended September 30, Nine Months Ended September 30, 2021 2020 2021 2020 Net (loss) income $ (5,306) $ 6,447 $ 8,373 $ 22,673 Add back: Depreciation and amortization 3,406 3,537 10,426 11,206 Interest expense 3,464 5,668 14,129 18,275 Provision for income taxes (2,123) 430 3,861 1,491 EBITDA $ (559) $ 16,082 $ 36,789 $ 53,645 Add back: Restructuring and transaction costs (1) (49) 171 1,491 3,143 Other general income (2) — — — (10,950) Loss on extinguishment of debt (3) 15,155 — 15,155 — Other (expense) income, net (4) 352 213 881 (1,925) Contingent consideration (5) — (1,427) — (1,427) LTIP bonus (6) 520 — 1,804 — Adjusted EBITDA $ 15,419 $ 15,039 $ 56,120 $ 42,486 Less: Capital expenditures (719) (1,275) (2,225) (3,913) Adjusted EBITDA less capital expenditures $ 14,700 $ 13,764 $ 53,895 $ 38,573 Adjusted EBITDA conversion rate 95% 92% 96% 91% Adjusted EBITDA margin (7) 15.6% 14.2% 17.3% 14.3%

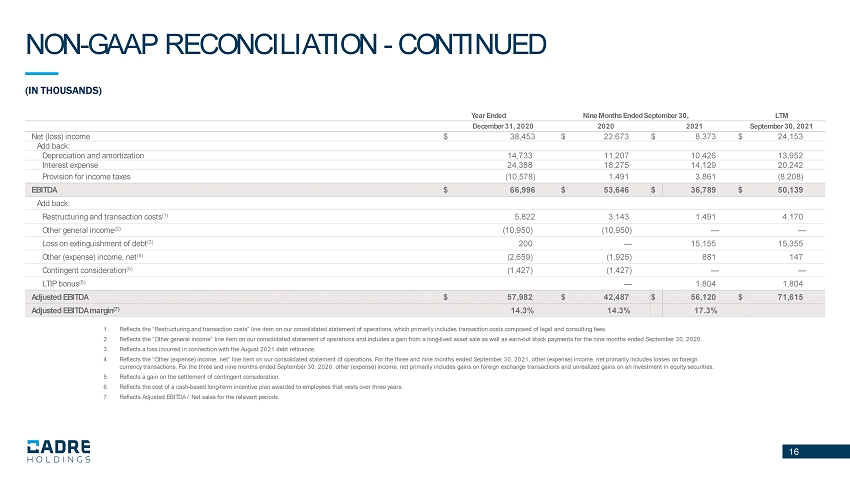

16 1. Reflects the “Restructuring and transaction costs” line item on our consolidated statement of operations, which primarily inc lud es transaction costs composed of legal and consulting fees. 2. Reflects the “Other general income” line item on our consolidated statement of operations and includes a gain from a long - lived asset sale as well as earn - out stock payments for the nine months ended September 30, 2020. 3. Reflects a loss incurred in connection with the August 2021 debt refinance. 4. Reflects the “Other (expense) income, net” line item on our consolidated statement of operations. For the three and nine months ended September 30, 2021, other (expense) income, net primarily includes losses on foreign currency transactions. For the three and nine months ended September 30, 2020, other (expense) income, net primarily includes ga ins on foreign exchange transactions and unrealized gains on an investment in equity securities. 5. Reflects a gain on the settlement of contingent consideration. 6. Reflects the cost of a cash - based long - term incentive plan awarded to employees that vests over three years. 7. Reflects Adjusted EBITDA / Net sales for the relevant periods. NON - GAAP RECONCILIATION - CONTINUED 16 (IN THOUSANDS) Year Ended Nine Months Ended September 30, LTM December 31, 2020 2020 2021 September 30, 2021 Net (loss) income $ 38,453 $ 22,673 $ 8,373 $ 24,153 Add back: Depreciation and amortization 14,733 11,207 10,426 13,952 Interest expense 24,388 18,275 14,129 20,242 Provision for income taxes (10,578) 1,491 3,861 (8,208) EBITDA $ 66,996 $ 53,646 $ 36,789 $ 50,139 Add back: Restructuring and transaction costs (1) 5,822 3,143 1,491 4,170 Other general income (2) (10,950) (10,950) — — Loss on extinguishment of debt (3) 200 — 15,155 15,355 Other (expense) income, net (4) (2,659) (1,925) 881 147 Contingent consideration (5) (1,427) (1,427) — — LTIP bonus (6) — 1,804 1,804 Adjusted EBITDA $ 57,982 $ 42,487 $ 56,120 $ 71,615 Adjusted EBITDA margin (7) 14.3% 14.3% 17.3%

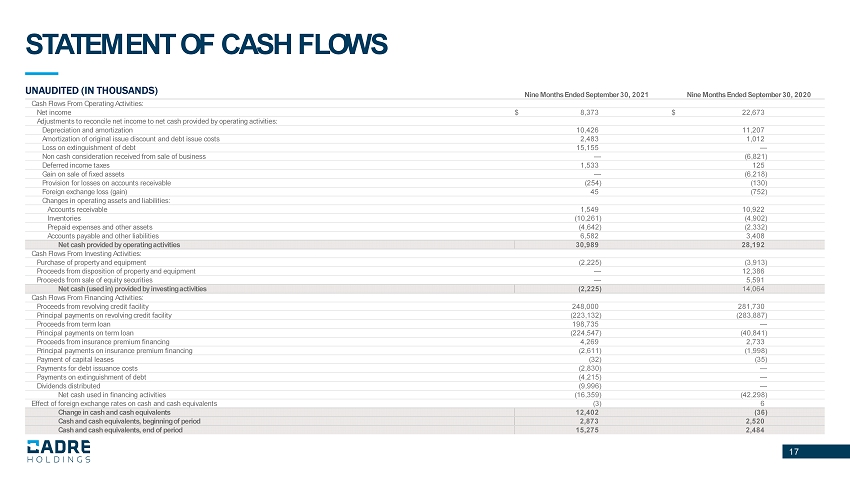

17 STATEMENT OF CASH FLOWS 17 UNAUDITED (IN THOUSANDS) Nine Months Ended September 30, 2021 Nine Months Ended September 30, 2020 Cash Flows From Operating Activities: Net income $ 8,373 $ 22,673 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 10,426 11,207 Amortization of original issue discount and debt issue costs 2,483 1,012 Loss on extinguishment of debt 15,155 — Non cash consideration received from sale of business — (6,821) Deferred income taxes 1,533 125 Gain on sale of fixed assets — (6,218) Provision for losses on accounts receivable (254) (130) Foreign exchange loss (gain) 45 (752) Changes in operating assets and liabilities: Accounts receivable 1,549 10,922 Inventories (10,261) (4,902) Prepaid expenses and other assets (4,642) (2,332) Accounts payable and other liabilities 6,582 3,408 Net cash provided by operating activities 30,989 28,192 Cash Flows From Investing Activities: Purchase of property and equipment (2,225) (3,913) Proceeds from disposition of property and equipment — 12,386 Proceeds from sale of equity securities — 5,591 Net cash (used in) provided by investing activities (2,225) 14,064 Cash Flows From Financing Activities: Proceeds from revolving credit facility 248,000 281,730 Principal payments on revolving credit facility (223,132) (283,887) Proceeds from term loan 198,735 — Principal payments on term loan (224,547) (40,841) Proceeds from insurance premium financing 4,269 2,733 Principal payments on insurance premium financing (2,611) (1,998) Payment of capital leases (32) (35) Payments for debt issuance costs (2,830) — Payments on extinguishment of debt (4,215) — Dividends distributed (9,996) — Net cash used in financing activities (16,359) (42,298) Effect of foreign exchange rates on cash and cash equivalents (3) 6 Change in cash and cash equivalents 12,402 (36) Cash and cash equivalents, beginning of period 2,873 2,520 Cash and cash equivalents, end of period 15,275 2,484

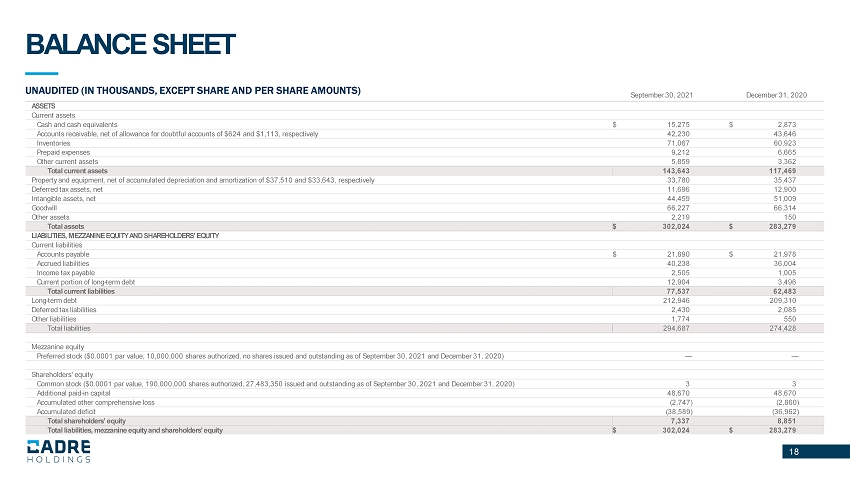

18 BALANCE SHEET 18 UNAUDITED (IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS) September 30, 2021 December 31, 2020 ASSETS Current assets Cash and cash equivalents $ 15,275 $ 2,873 Accounts receivable, net of allowance for doubtful accounts of $624 and $1,113, respectively 42,230 43,646 Inventories 71,067 60,923 Prepaid expenses 9,212 6,665 Other current assets 5,859 3,362 Total current assets 143,643 117,469 Property and equipment, net of accumulated depreciation and amortization of $37,510 and $33,643, respectively 33,780 35,437 Deferred tax assets, net 11,696 12,900 Intangible assets, net 44,459 51,009 Goodwill 66,227 66,314 Other assets 2,219 150 Total assets $ 302,024 $ 283,279 LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable $ 21,890 $ 21,978 Accrued liabilities 40,238 36,004 Income tax payable 2,505 1,005 Current portion of long - term debt 12,904 3,496 Total current liabilities 77,537 62,483 Long - term debt 212,946 209,310 Deferred tax liabilities 2,430 2,085 Other liabilities 1,774 550 Total liabilities 294,687 274,428 Mezzanine equity Preferred stock ($0.0001 par value, 10,000,000 shares authorized, no shares issued and outstanding as of September 30, 2021 a nd December 31, 2020) — — Shareholders' equity Common stock ($0.0001 par value, 190,000,000 shares authorized, 27,483,350 issued and outstanding as of September 30, 2021 an d D ecember 31, 2020) 3 3 Additional paid - in capital 48,670 48,670 Accumulated other comprehensive loss (2,747) (2,860) Accumulated deficit (38,589) (36,962) Total shareholders’ equity 7,337 8,851 Total liabilities, mezzanine equity and shareholders' equity $ 302,024 $ 283,279