EX-99.2

Published on November 10, 2022

|

THIRD QUARTER 2022 |

|

2 FORWARD - LOOKING STATEMENTS Except for historical information, certain matters discussed in this presentation may be forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements include but are not limited to all projections and anticipated levels of future performance. Forward - looking statements involve risks, uncertainties and other factors that may cause our actual results to differ materially from those discussed herein. Any number of factors could cause actual results to differ materially from projections or forward - looking statements, including without limitation, changes to global economic, social and political conditions, spending patterns of government agencies, competitive pressures, the impact of acquisitions and related integration activities, logistical challenges related to disruptions and delays, product liability claims, the success of new product introductions, currency exchange rate fluctuations and the risks of doin g business in the markets in which we operate, including foreign countries. More information on potential factors that could affect the Company’s financial results are more fully described from time to time in the Company’s public reports filed with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, and Current Reports on Form 8 - K. All forward - looking statements included in this presentation are based upon information available to the Company as of the date of this presentation, and speak only as of the date hereof. We assume no obligation to update any forward - looking statements to reflect events or circumstances after the date of this presentation .. 2 |

|

TODAY’S PRESENTERS 3 BRAD WILLIAMS President BLAINE BROWERS Chief Financial Officer WARREN KANDERS Chief Executive Officer and Chairman of the Board |

|

4 AGENDA • Q3 Review • Business Overview • Financial Summary • Full Year Outlook • Conclusion and Q&A |

|

5 CONTINUED EXECUTION IN Q3 5 Cadre continues to deliver on strategic objectives in a challenging supply chain and inflationary environment Pricing Growth: ✓ Exceeded 1% target above material inflation Adjusted EBITDA Conversion: 1 ✓ Generated Adj. EBITDA conversion of 97% in Q3, above the high end of guidance range Q3 Mix: ✓ Higher Duty Gear shipments and improved product mix as expected Orders Backlog: ✓ Maintained strong orders backlog of $125.2 million as of September 30, 2022 Healthy M&A Funnel: ✓ Continue to actively evaluate robust pipeline of opportunities Returned Capital to Shareholders: ✓ Declared fifth consecutive quarterly dividend of $0.08 Commentary: 1. Adj. EBITDA conversion (%) defined as (Adj. EBITDA – capital expenditure) / Adj. EBITDA. Adjusted EBITDA is a non - GAAP financial measure. See slide 19 for definitions and reconciliations to the nearest GAAP measures |

|

6 MACRO TAILWINDS SUPPORT LONG TERM SUSTAINABLE GROWTH OPPORTUNITY Two - thirds of all NATO countries spend less than 2% of GDP targets on defense and security Amidst current geopolitical turmoil, European leaders have advocated for significant increases in defense budgets Police protection expenditures have continued to trend upward even during previous financial and industrial recessions Major US cities continue to increase police budgets The American Rescue Plan provides $350 billion to hire more police |

|

7 7 • Spend per officer increasing but police departments still struggling to fill open positions • Amid continued war in Ukraine, uptick in inquiries, which have resulted in small orders • Anticipate larger opportunities to provide safety and survivability equipment as conflict continues • Continuing to experience extended lead times with fabrics, electronic components and various raw materials • Seeing stabilized run rate for holster demand North American Law Enforcement Geopolitical Landscape Supply Chain Consumer LATEST MARKET TRENDS |

|

8 20 20 13 CADRE'S KEY M&A CRITERIA Niche market No large - cap competition Leading market position Cost structure where material > labor Leading a nd d efensible technology High cost of substitution Mission - critical to customer Recurring revenue profile Asset - light Business Financial Market Strong brand recognition Attractive ROIC Resiliency through market c ycles CADRE'S KEY M&A CRITERIA 8 |

|

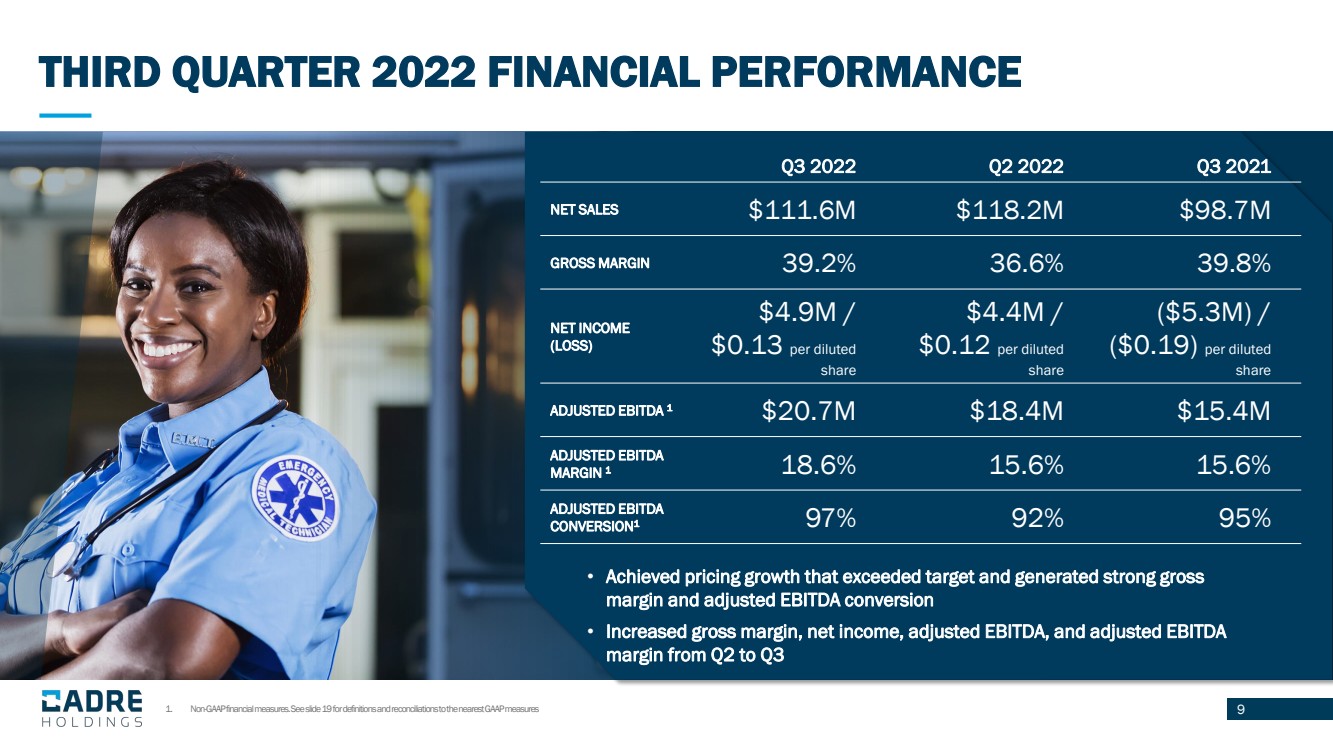

THIRD QUARTER 2022 FINANCIAL PERFORMANCE Q3 2022 Q2 2022 Q3 2021 NET SALES $111.6M $118.2M $98.7M GROSS MARGIN 39.2% 36.6% 39.8% NET INCOME (LOSS) $4.9M / $0.13 per diluted share $4.4M / $0.12 per diluted share ($5.3M) / ($0.19) per diluted share ADJUSTED EBITDA 1 $20.7M $18.4M $15.4M ADJUSTED EBITDA MARGIN 1 18.6% 15.6% 15.6% ADJUSTED EBITDA CONVERSION 1 97% 92% 95% 1. Non - GAAP financial measures. See slide 19 for definitions and reconciliations to the nearest GAAP measures • Achieved pricing growth that exceeded target and generated strong gross margin and adjusted EBITDA conversion • Increased gross margin, net income, adjusted EBITDA, and adjusted EBITDA margin from Q2 to Q3 9 |

|

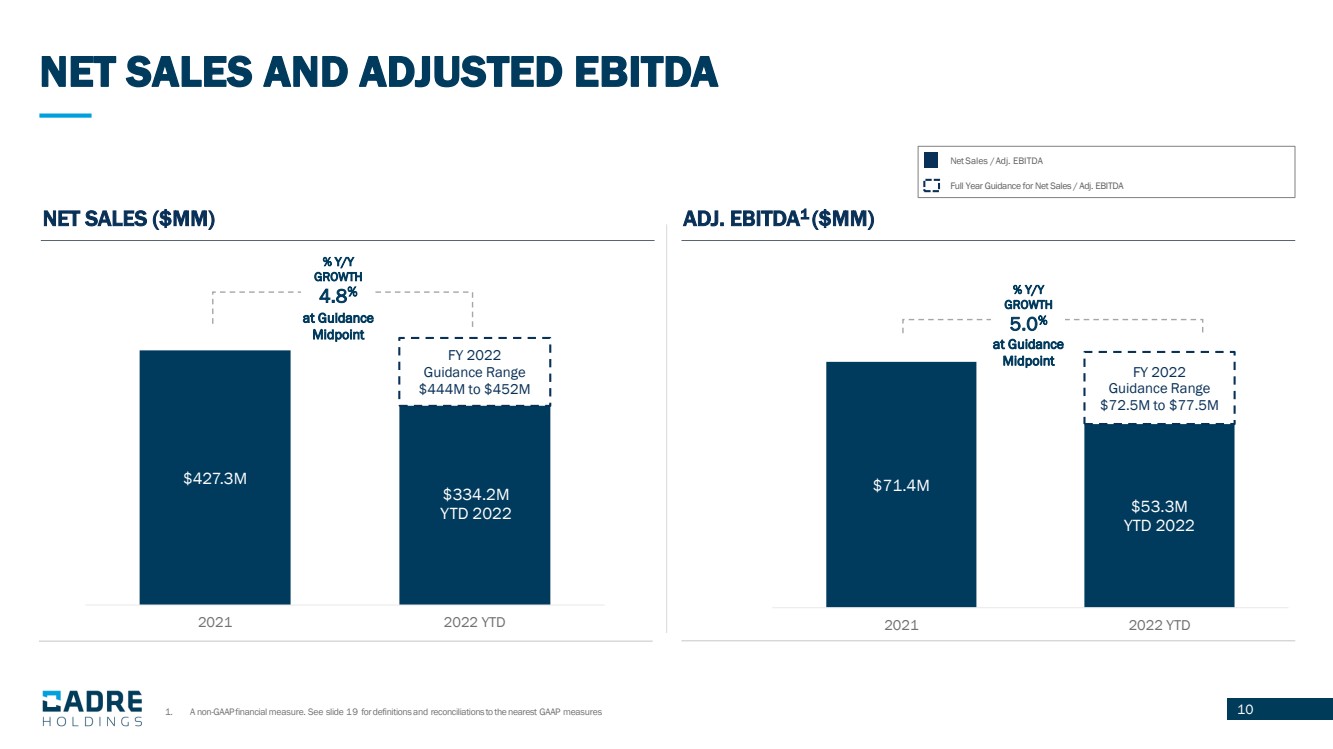

10 Net Sales / Adj. EBITDA Full Year Guidance for Net Sales / Adj. EBITDA NET SALES AND ADJUSTED EBITDA NET SALES ($MM) $427.3M $334.2M YTD 2022 FY 2022 Guidance Range $444M to $452M 2021 2022 YTD % Y/Y GROWTH 4.8 % at Guidance Midpoint ADJ. EBITDA 1 ($MM) $71.4M $53.3M YTD 2022 FY 2022 Guidance Range $72.5M to $77.5M 2021 2022 YTD % Y/Y GROWTH 5.0 % at Guidance Midpoint 1. A non - GAAP financial measure. See slide 19 for definitions and reconciliations to the nearest GAAP measures |

|

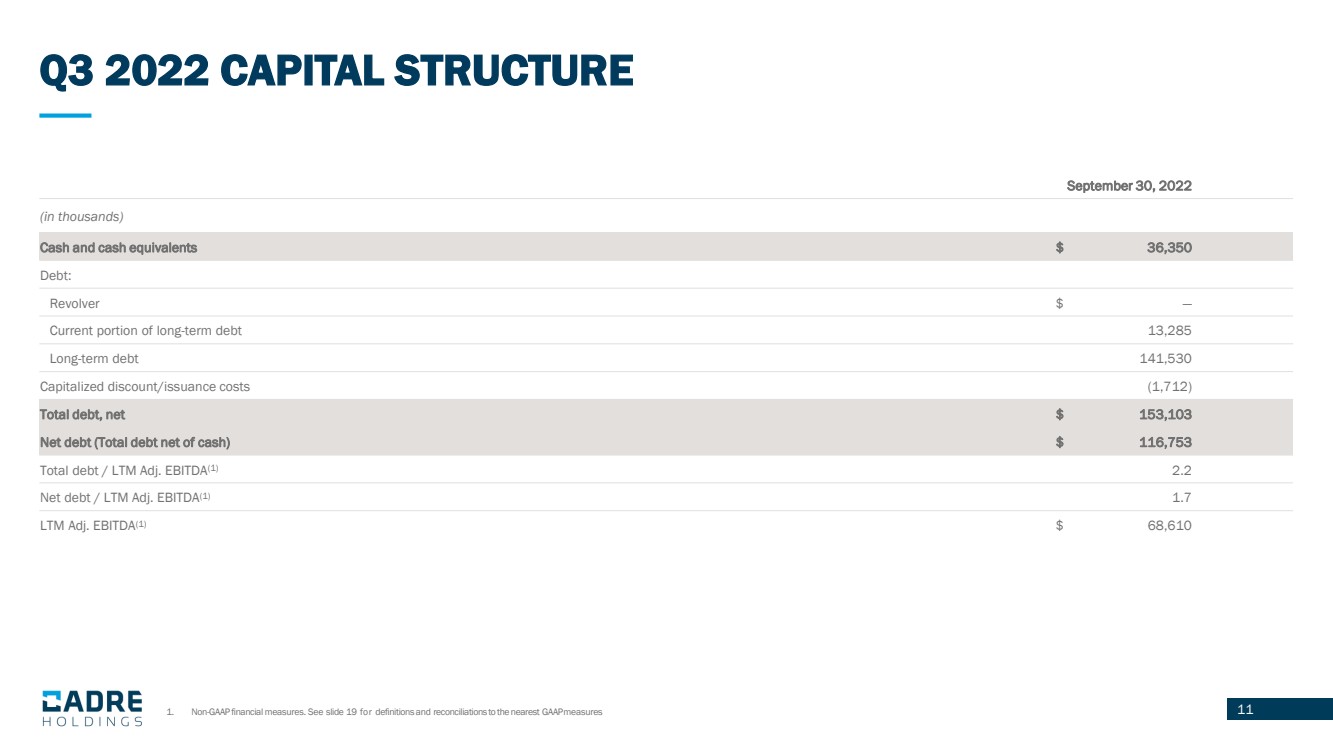

11 Q3 2022 CAPITAL STRUCTURE 1. Non - GAAP financial measures. See slide 19 for definitions and reconciliations to the nearest GAAP measures September 30, 2022 (in thousands) Cash and cash equivalents $ 36,350 Debt: Revolver $ — Current portion of long - term debt 13,285 Long - term debt 141,530 Capitalized discount/issuance costs (1,712) Total debt, net $ 153,103 Net debt (Total debt net of cash) $ 116,753 Total debt / LTM Adj. EBITDA (1) 2.2 Net debt / LTM Adj. EBITDA (1) 1.7 LTM Adj. EBITDA (1) $ 68,610 |

|

12 REAFFIRM 2022 MANAGEMENT OUTLOOK 2022 GUIDANCE NET SALES $444M to $452M Adj. EBITDA $72.5M to $77.5M Adj. EBITDA Conversion 92% to 95% 1. A non - GAAP financial measure. See slide 19 for definitions and reconciliations to the nearest GAAP measures |

|

CONCLUSION 13 Accelerate Organic Revenue Growth Pursue M&A Opportunities Continuously Improve Gross and Adj. EBITDA Margins |

|

14 APPENDIX |

|

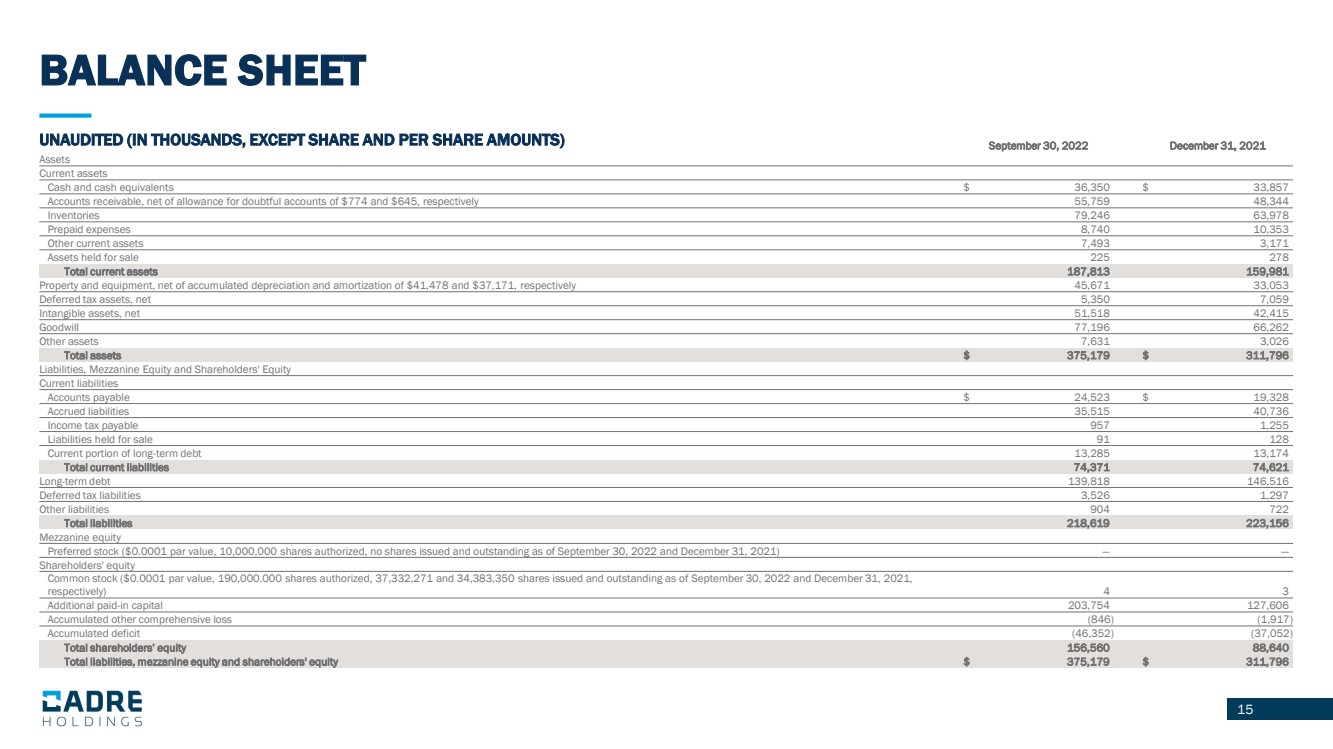

15 BALANCE SHEET 15 UNAUDITED (IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS) September 30, 2022 December 31, 2021 Assets Current assets Cash and cash equivalents $ 36,350 $ 33,857 Accounts receivable, net of allowance for doubtful accounts of $774 and $645, respectively 55,759 48,344 Inventories 79,246 63,978 Prepaid expenses 8,740 10,353 Other current assets 7,493 3,171 Assets held for sale 225 278 Total current assets 187,813 159,981 Property and equipment, net of accumulated depreciation and amortization of $41,478 and $37,171, respectively 45,671 33,053 Deferred tax assets, net 5,350 7,059 Intangible assets, net 51,518 42,415 Goodwill 77,196 66,262 Other assets 7,631 3,026 Total assets $ 375,179 $ 311,796 Liabilities, Mezzanine Equity and Shareholders' Equity Current liabilities Accounts payable $ 24,523 $ 19,328 Accrued liabilities 35,515 40,736 Income tax payable 957 1,255 Liabilities held for sale 91 128 Current portion of long - term debt 13,285 13,174 Total current liabilities 74,371 74,621 Long - term debt 139,818 146,516 Deferred tax liabilities 3,526 1,297 Other liabilities 904 722 Total liabilities 218,619 223,156 Mezzanine equity Preferred stock ($0.0001 par value, 10,000,000 shares authorized, no shares issued and outstanding as of September 30, 2022 and December 31, 2021) — — Shareholders' equity Common stock ($0.0001 par value, 190,000,000 shares authorized, 37,332,271 and 34,383,350 shares issued and outstanding as of Se ptember 30, 2022 and December 31, 2021, respectively) 4 3 Additional paid - in capital 203,754 127,606 Accumulated other comprehensive loss (846) (1,917) Accumulated deficit (46,352) (37,052) Total shareholders’ equity 156,560 88,640 Total liabilities, mezzanine equity and shareholders' equity $ 375,179 $ 311,796 |

|

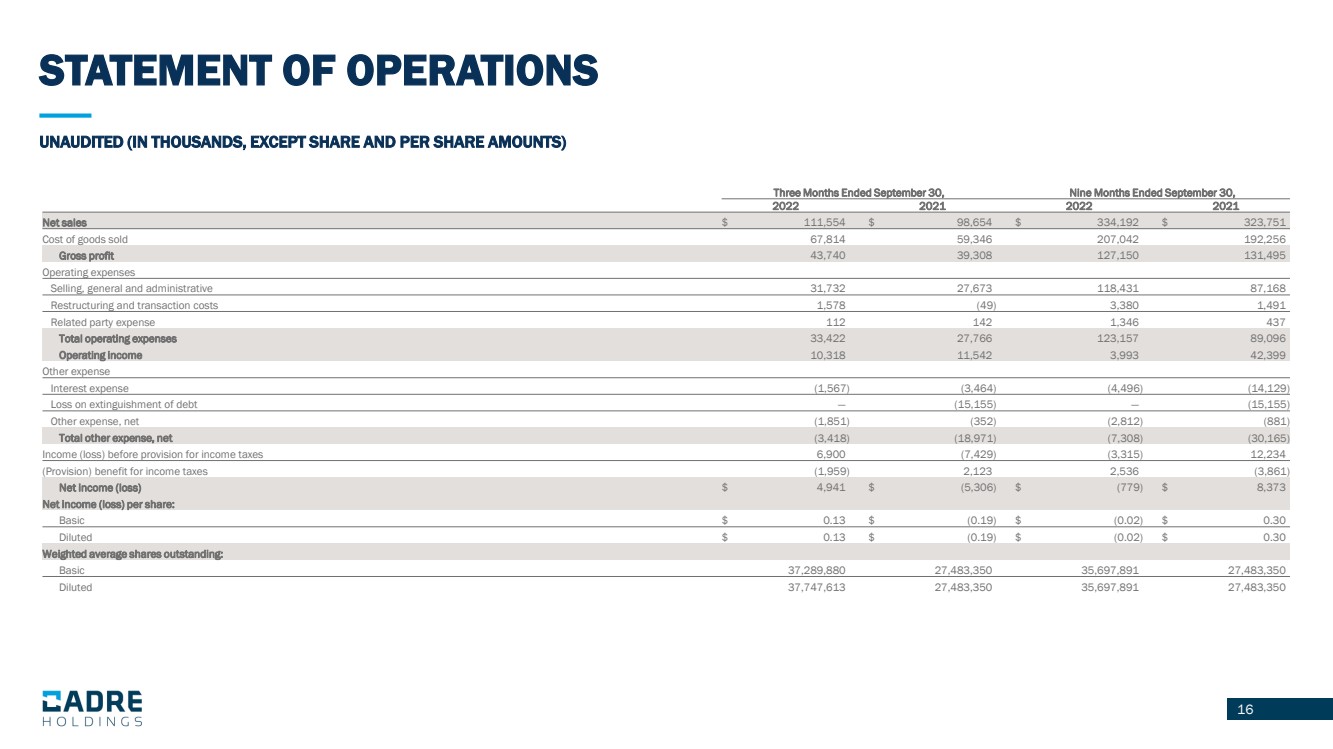

16 STATEMENT OF OPERATIONS 16 UNAUDITED (IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS) Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2022 2021 Net sales $ 111,554 $ 98,654 $ 334,192 $ 323,751 Cost of goods sold 67,814 59,346 207,042 192,256 Gross profit 43,740 39,308 127,150 131,495 Operating expenses Selling, general and administrative 31,732 27,673 118,431 87,168 Restructuring and transaction costs 1,578 (49) 3,380 1,491 Related party expense 112 142 1,346 437 Total operating expenses 33,422 27,766 123,157 89,096 Operating income 10,318 11,542 3,993 42,399 Other expense Interest expense (1,567) (3,464) (4,496) (14,129) Loss on extinguishment of debt — (15,155) — (15,155) Other expense, net (1,851) (352) (2,812) (881) Total other expense, net (3,418) (18,971) (7,308) (30,165) Income (loss) before provision for income taxes 6,900 (7,429) (3,315) 12,234 (Provision) benefit for income taxes (1,959) 2,123 2,536 (3,861) Net income (loss) $ 4,941 $ (5,306) $ (779) $ 8,373 Net income (loss) per share: Basic $ 0.13 $ (0.19) $ (0.02) $ 0.30 Diluted $ 0.13 $ (0.19) $ (0.02) $ 0.30 Weighted average shares outstanding: Basic 37,289,880 27,483,350 35,697,891 27,483,350 Diluted 37,747,613 27,483,350 35,697,891 27,483,350 |

|

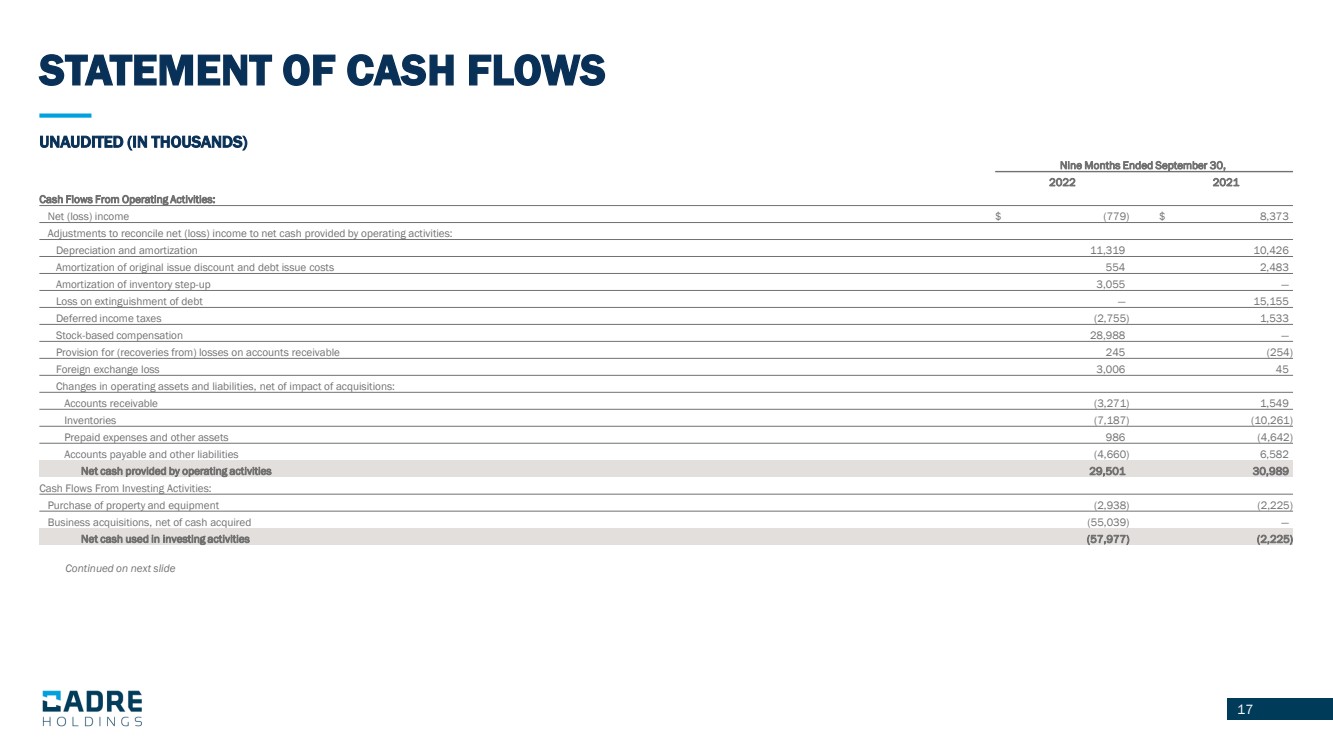

17 STATEMENT OF CASH FLOWS 17 UNAUDITED (IN THOUSANDS) Continued on next slide Nine Months Ended September 30, 2022 2021 Cash Flows From Operating Activities: Net (loss) income $ (779) $ 8,373 Adjustments to reconcile net (loss) income to net cash provided by operating activities: Depreciation and amortization 11,319 10,426 Amortization of original issue discount and debt issue costs 554 2,483 Amortization of inventory step - up 3,055 — Loss on extinguishment of debt — 15,155 Deferred income taxes (2,755) 1,533 Stock - based compensation 28,988 — Provision for (recoveries from) losses on accounts receivable 245 (254) Foreign exchange loss 3,006 45 Changes in operating assets and liabilities, net of impact of acquisitions: Accounts receivable (3,271) 1,549 Inventories (7,187) (10,261) Prepaid expenses and other assets 986 (4,642) Accounts payable and other liabilities (4,660) 6,582 Net cash provided by operating activities 29,501 30,989 Cash Flows From Investing Activities: Purchase of property and equipment (2,938) (2,225) Business acquisitions, net of cash acquired (55,039) — Net cash used in investing activities (57,977) (2,225) |

|

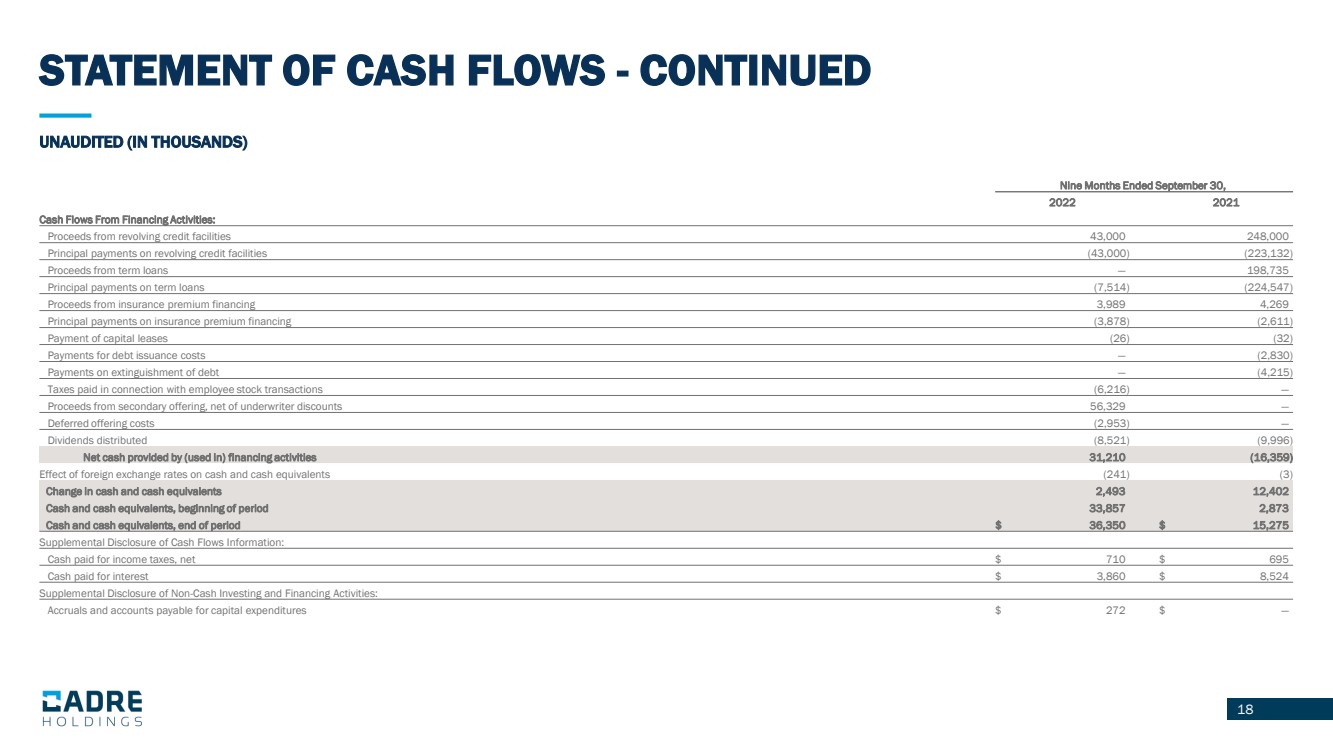

18 STATEMENT OF CASH FLOWS - CONTINUED 18 UNAUDITED (IN THOUSANDS) Nine Months Ended September 30, 2022 2021 Cash Flows From Financing Activities: Proceeds from revolving credit facilities 43,000 248,000 Principal payments on revolving credit facilities (43,000) (223,132) Proceeds from term loans — 198,735 Principal payments on term loans (7,514) (224,547) Proceeds from insurance premium financing 3,989 4,269 Principal payments on insurance premium financing (3,878) (2,611) Payment of capital leases (26) (32) Payments for debt issuance costs — (2,830) Payments on extinguishment of debt — (4,215) Taxes paid in connection with employee stock transactions (6,216) — Proceeds from secondary offering, net of underwriter discounts 56,329 — Deferred offering costs (2,953) — Dividends distributed (8,521) (9,996) Net cash provided by (used in) financing activities 31,210 (16,359) Effect of foreign exchange rates on cash and cash equivalents (241) (3) Change in cash and cash equivalents 2,493 12,402 Cash and cash equivalents, beginning of period 33,857 2,873 Cash and cash equivalents, end of period $ 36,350 $ 15,275 Supplemental Disclosure of Cash Flows Information: Cash paid for income taxes, net $ 710 $ 695 Cash paid for interest $ 3,860 $ 8,524 Supplemental Disclosure of Non - Cash Investing and Financing Activities: Accruals and accounts payable for capital expenditures $ 272 $ — |

|

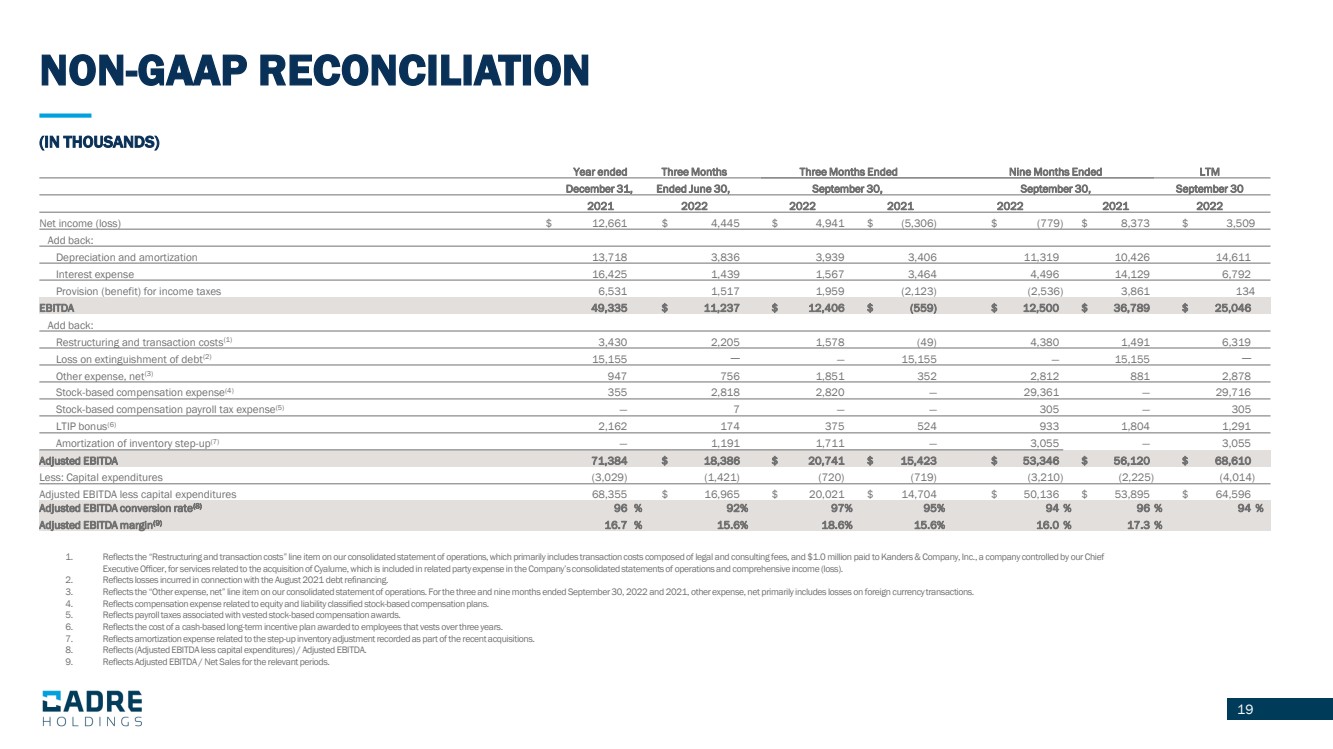

19 1. Reflects the “Restructuring and transaction costs” line item on our consolidated statement of operations, which primarily inc lud es transaction costs composed of legal and consulting fees, and $1.0 million paid to Kanders & Company, Inc., a company controlled by our Chief Executive Officer, for services related to the acquisition of Cyalume , which is included in related party expense in the Company’s consolidated statements of operations and comprehensive income (lo ss). 2. Reflects losses incurred in connection with the August 2021 debt refinancing. 3. Reflects the “Other expense, net” line item on our consolidated statement of operations. For the three and nine months ended Sep tember 30, 2022 and 2021, other expense, net primarily includes losses on foreign currency transactions. 4. Reflects compensation expense related to equity and liability classified stock - based compensation plans. 5. Reflects payroll taxes associated with vested stock - based compensation awards. 6. Reflects the cost of a cash - based long - term incentive plan awarded to employees that vests over three years. 7. Reflects amortization expense related to the step - up inventory adjustment recorded as part of the recent acquisitions. 8. Reflects (Adjusted EBITDA less capital expenditures) / Adjusted EBITDA. 9. Reflects Adjusted EBITDA / Net Sales for the relevant periods. 19 (IN THOUSANDS) NON - GAAP RECONCILIATION Year ended Three Months Three Months Ended Nine Months Ended LTM December 31, Ended June 30, September 30, September 30, September 30 2021 2022 2022 2021 2022 2021 2022 Net income (loss) $ 12,661 $ 4,445 $ 4,941 $ (5,306) $ (779) $ 8,373 $ 3,509 Add back: Depreciation and amortization 13,718 3,836 3,939 3,406 11,319 10,426 14,611 Interest expense 16,425 1,439 1,567 3,464 4,496 14,129 6,792 Provision (benefit) for income taxes 6,531 1,517 1,959 (2,123) (2,536) 3,861 134 EBITDA 49,335 $ 11,237 $ 12,406 $ (559) $ 12,500 $ 36,789 $ 25,046 Add back: Restructuring and transaction costs (1) 3,430 2,205 1,578 (49) 4,380 1,491 6,319 Loss on extinguishment of debt (2) 15,155 — — 15,155 — 15,155 — Other expense, net (3) 947 756 1,851 352 2,812 881 2,878 Stock - based compensation expense (4) 355 2,818 2,820 — 29,361 — 29,716 Stock - based compensation payroll tax expense (5) — 7 — — 305 — 305 LTIP bonus (6) 2,162 174 375 524 933 1,804 1,291 Amortization of inventory step - up (7) — 1,191 1,711 — 3,055 — 3,055 Adjusted EBITDA 71,384 $ 18,386 $ 20,741 $ 15,423 $ 53,346 $ 56,120 $ 68,610 Less: Capital expenditures (3,029) (1,421) (720) (719) (3,210) (2,225) (4,014) Adjusted EBITDA less capital expenditures 68,355 $ 16,965 $ 20,021 $ 14,704 $ 50,136 $ 53,895 $ 64,596 Adjusted EBITDA conversion rate (8) 96 % 92 % 97 % 95 % 94 % 96 % 94 % Adjusted EBITDA margin (9) 16.7 % 15.6 % 18.6 % 15.6 % 16.0 % 17.3 % |